The financial management team is often considered the “heart” of an organization. Financial managers prepare accounting reports, offer investment insights, manage spending, and develop strategies to meet long-term financial goals. They also communicate and collaborate with every department in the company.

As the COVID-19 pandemic made remote work the norm, businesses adjusted how these crucial finance teams function. Nigel LeGresley, Acumatica’s COO/CFO, sat down with me to discuss how critical it is for companies in every industry to embrace the mobile finance office.

Q&A: The Mobile Finance Office

Question: One of my first questions has to be about the COVID-19 pandemic. How did it affect the way financial management teams function?

Nigel: The COVID-19 crisis created challenges for most businesses. Remote work became a necessity, and companies had to find ways to virtually connect their employees and their business management solutions. Some organizations seamlessly transitioned because they were already relying on a cloud ERP solution with mobile capabilities (like Acumatica), through which they could access critical business content from any web-enabled mobile device—at any time, from anywhere.

Financial management teams give their organizations data for critical decision-making. They must deliver that value every day, and, to accomplish this in the post-COVID-19 world, they cannot be constrained by office walls. They need modern, flexible financial management software that allows them to work anytime, anywhere—from the office, at home, or on the road.

Question: What barriers do customers face as they consider embracing a mobile finance office?

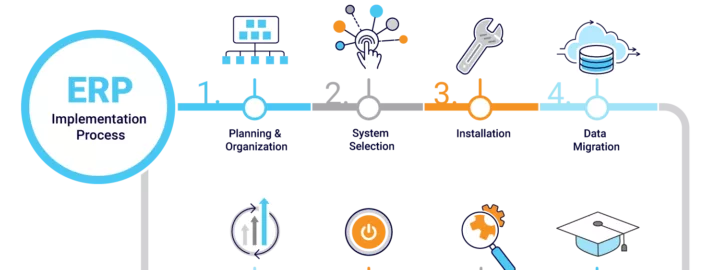

Nigel: To embrace a mobile finance office, businesses need to implement a remotely accessible, cloud-based ERP solution, but this can take time. It may not be a quick process. Companies just starting to pursue the idea will have to research the available solutions, weigh their options, and ultimately make their ERP selection. People don’t always think they have time to complete this process, but they absolutely must invest the time, effort, and capital. If they don’t, their competitors will pass them by.

Another barrier is that a company may think its legacy business and financial management system is just fine, but, most likely, it isn’t. These systems are typically inefficient, 20+-year-old technology, lacking the modern functionality of cloud-based solutions. A business must be confident that its system allows all its team members to connect to current data and work whenever, from wherever. That’s everyone—from the CEO, to sales, to operations, and beyond. When businesses realize legacy systems can’t fulfill these essential functions, they need to find and implement the right solution ASAP.

But not every business will know what functionality it needs in a cloud ERP solution and financial management software, and some will worry about the exponential costs of user-based pricing models. Of course, if they turn to Acumatica, they don’t have to know what functionality they need because Acumatica’s platform can grow and fluctuate with the business. And they don’t have to worry about user-based pricing because Acumatica charges for resource consumption, not number of users.

Question: Can you explain in more detail why customers don’t have to know all of their exact needs when they implement Acumatica’s cloud ERP software?

Nigel: We’re a flexible solution, so users can choose which modules they need now and add other modules later. For example, the General Business Edition with Financial Management is the hub of the ERP. Businesses can start there and add other modules as necessary. If they need functionality for manufacturing, they can add our Manufacturing Edition. Perhaps they’ll want to tack on Customer Relationship Management (CRM) or Payroll. They can. They can also remove modules if need be. So, they can expand or contract their Acumatica functionalities as their requirements change.

Our consumption-based pricing doesn’t lock companies into a specific number of users. As I mentioned, we charge for resources used. It’s a unique licensing model that can grow or shrink as customers’ needs change.

Because we’re a platform-based ERP with open APIs, businesses can review the Acumatica Marketplace, with our over 200 partners, and integrate with any third-party application they choose. Because Acumatica is a plug-and-play platform, customers can choose the solutions that best fit them. Our platform also differentiates us—starkly—from our competitors.

While we have formidable competitors, their solutions tend to be based on older technology. Acumatica uses the world’s best cloud and mobile technology to foster agility and open the door to a large volume of quality ISV solutions.

Question: You mentioned the modules Acumatica offers. Of these, which do you believe are the most important tools for the mobile finance office?

Nigel: Again, this will depend on each business’s needs, which will naturally shift over time. But, in general, financial management teams make three types of decisions: financing, investment, and dividend decisions. Of course, Acumatica’s General Ledger, Accounts Receivable, and Accounts Payable modules are critical, basic tools for fulfilling these roles. On a deeper level, though, the Project Accounting and Advanced Expense Management modules help with financing decisions, giving financial management teams dynamic tools for budgeting, tracking product costs, shortening expense cycles, and tracing data transactions—all with powerful automation, artificial intelligence (AI), and machine learning (ML). Investment decisions are easier with our Reporting, Dashboard, and Data Analysis Tools, which offer a customizable view of the whole business, so people can examine and act on real-time trends. And dividend decisions benefit from the Recurring Revenue Management module, through which companies can control various pricing models and improve revenue flow. These are just a few of the options Acumatica offers that can help businesses grow through their integrated mobile finance offices.

Question: Overall, how can cloud ERP software benefit the financial management team and a business as a whole?

Nigel: As I’ve said, Acumatica Cloud ERP is remarkably flexible for businesses, both in available modules and pricing structure. It delivers a level of high-quality value and efficiency that disconnected, legacy solutions just can’t reach. Businesses and their employees can personalize their Acumatica, Tableau, or PowerBI dashboards and handle cash flow, accounts payable, accounts receivable, sales, and more within a single, centralized solution—all on their mobile devices.

When financial management team members—or people from any department—have an easy-to-use system geared to their specific needs, their workplace satisfaction levels (and employee retention rates) increase. The cloud ERP system places real-time information and reports at these teams’ fingertips. They can then consistently and securely share this information with coworkers—making data support decisions and ultimately building world-class organizations.

Critical Remote Access with the Mobile Finance Office

My thanks to Nigel for a great conversation on an important topic. He wrapped up by noting that the many advantages of implementing a comprehensive cloud ERP solution and financial management software are enveloped by the overarching benefit that is the mobile finance office. Finance teams can access their updated, synchronized data whenever, from wherever. This mobility is critical at a time when the remote workforce seems to be becoming standard.

To learn more about Acumatica Cloud ERP or to request a demonstration, please contact our experts today.