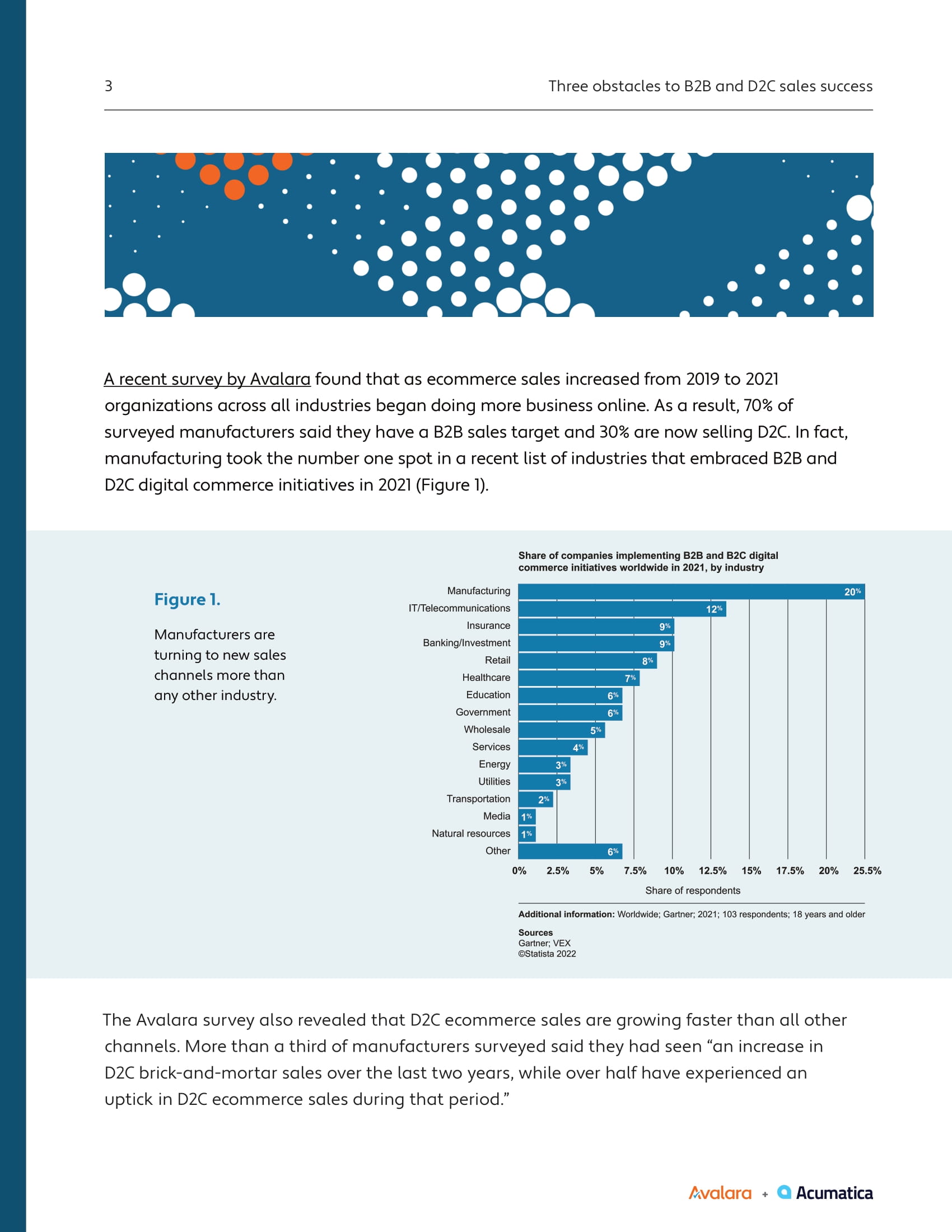

In the wake of the COVID-19 pandemic and the many upheavals and disruptions it brought, manufacturers have devised new ways to stay profitable. For many, this has meant expanding into business-to-business (B2B) and direct-to-consumer (D2C) sales channels.

These moves have opened a whole new world of possibilities for today’s manufacturers. But they’ve also created new challenges. As eCommerce has boomed, tax laws have become increasingly complex. Customers now have high standards for convenient, simple, and personalized omnichannel experiences. And aging technology is becoming a liability for swiftly diversifying companies.